The Single Strategy To Use For San Diego Home Insurance

The Single Strategy To Use For San Diego Home Insurance

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Policy Program

Importance of Affordable Home Insurance Coverage

Protecting cost effective home insurance policy is critical for securing one's residential or commercial property and monetary wellness. Home insurance coverage offers security versus numerous risks such as fire, theft, all-natural disasters, and individual responsibility. By having a comprehensive insurance coverage strategy in place, house owners can rest assured that their most significant financial investment is safeguarded in the occasion of unforeseen scenarios.

Budget-friendly home insurance coverage not only supplies monetary protection but likewise provides peace of mind (San Diego Home Insurance). Despite rising property worths and building and construction expenses, having a cost-efficient insurance plan guarantees that house owners can quickly reconstruct or fix their homes without encountering considerable financial burdens

In addition, budget friendly home insurance can likewise cover personal belongings within the home, offering reimbursement for products harmed or taken. This insurance coverage expands past the physical framework of the house, shielding the contents that make a house a home.

Insurance Coverage Options and Boundaries

When it comes to protection limits, it's crucial to recognize the maximum amount your plan will pay for each type of protection. These limitations can differ depending upon the policy and insurance firm, so it's essential to examine them carefully to guarantee you have sufficient protection for your home and assets. By comprehending the protection options and limitations of your home insurance plan, you can make enlightened choices to protect your home and liked ones effectively.

Elements Impacting Insurance Coverage Expenses

Several variables substantially affect the prices of home insurance plans. The place of your home plays an essential function in determining the insurance coverage costs.

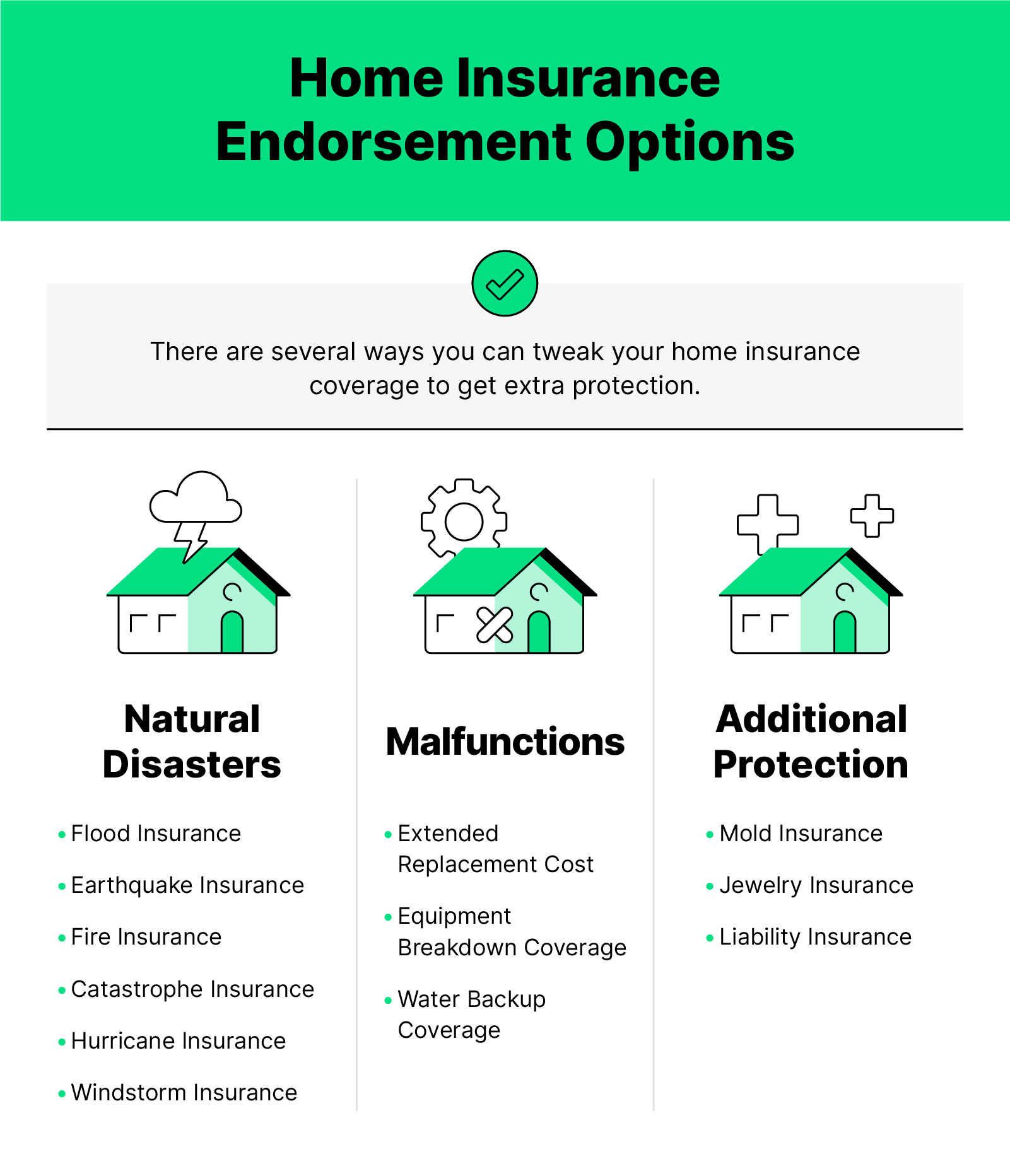

Additionally, the kind of protection you pick directly affects the price of your insurance plan. Going with additional protection choices such as flooding insurance policy or earthquake insurance coverage will certainly raise your premium. Picking greater protection limitations will certainly look at this now result in higher costs. Your insurance deductible quantity can likewise affect your insurance expenses. A greater deductible generally indicates lower premiums, but you will have to pay more out of pocket in case of a case.

Furthermore, your credit report, declares background, and the insurer you pick can all affect the cost of your home insurance coverage. By considering these elements, you can make educated decisions to help manage your insurance coverage sets you back successfully.

Comparing Service Providers and quotes

Along with comparing quotes, it is important to review the online reputation and financial security of the insurance coverage carriers. Seek client evaluations, rankings from independent agencies, and any kind of history of problems or governing activities. A dependable insurance coverage service provider must have a great track document of promptly processing insurance claims and supplying excellent consumer solution.

In addition, consider the details coverage attributes provided by each service provider. Some insurers might offer extra benefits such as identification burglary security, equipment failure protection, or insurance coverage for high-value products. By very carefully contrasting carriers and quotes, you can make an informed choice and select the home insurance policy plan that best fulfills your requirements.

Tips for Reducing Home Insurance Policy

After extensively contrasting service providers and quotes to find the most suitable coverage for your requirements and spending plan, it is prudent to explore reliable strategies for conserving on home insurance coverage. Several insurance business offer discount rates if you acquire several policies from them, such as combining your home and car insurance coverage. On a regular basis evaluating and upgrading your plan to reflect any kind of modifications in your home or situations can ensure you are not paying for insurance coverage you no longer requirement, aiding you save cash on your home insurance costs.

Conclusion

In conclusion, guarding your home and enjoyed ones with affordable home insurance is critical. Comprehending insurance coverage restrictions, variables, and choices impacting insurance policy expenses can aid you make informed choices. By contrasting quotes and service providers, you can locate the most effective plan that fits your requirements and spending plan. Applying tips for saving money on home insurance policy can additionally aid you safeguard the required protection for your home without damaging the bank.

By untangling the details of home insurance coverage strategies and discovering sensible strategies for safeguarding affordable protection, you can make certain that your home and liked ones are well-protected.

Home insurance policy plans usually offer a number of protection alternatives to safeguard your home and valuables - San Diego Home Insurance. By understanding the insurance coverage choices and restrictions of your home insurance coverage plan, you can make educated choices to secure your home and liked ones you could look here properly

Consistently examining and updating your plan to reflect any changes in your home or scenarios can ensure you are not paying for insurance coverage you no longer need, aiding you save cash on your home insurance premiums.

In final thought, safeguarding your home and liked ones with cost effective home insurance is critical.

Report this page